The cryptocurrency market is facing a heated debate as Bitcoin enthusiasts slam the recent billion-dollar surge into altcoin balance sheets. While Bitcoin (BTC) remains the leading cryptocurrency, institutional and retail…

As of September 17, 2025, homeowners with Home Equity Lines of Credit (HELOCs) are closely monitoring the Federal Reserve’s anticipated interest rate cut. The Fed is expected to reduce the…

If you’re serious about building wealth and achieving financial milestones faster, a high-yield savings account with “savings buckets” might be your secret weapon. Unlike traditional savings accounts, these modern accounts…

In 2025, digital banking continues to redefine how we manage money, and Chime remains at the forefront of this revolution. By leveraging cutting-edge technology, Chime offers users smarter, faster, and…

If you’re looking for a high-yield online savings account in 2025, Poppy Bank is quickly becoming a top choice for savers across the United States. Based in California, Poppy Bank…

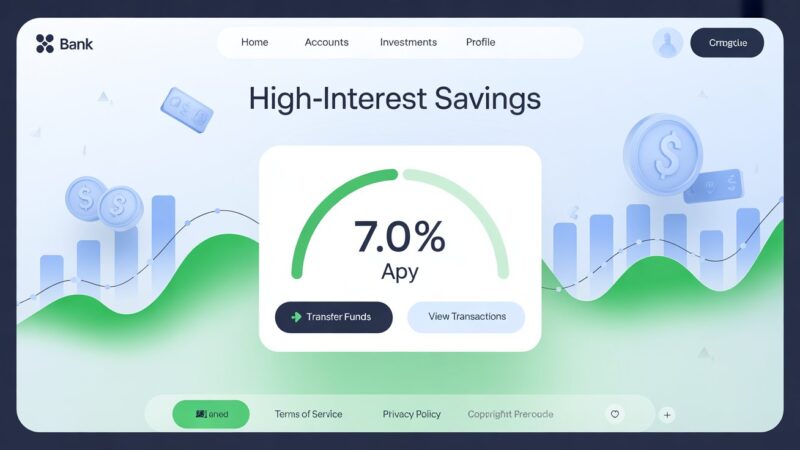

While 7% interest rates are rare in the U.S., some financial institutions in the UK are offering competitive rates: In the U.S., the highest high-yield savings account rates are currently…

Improving your financial well-being doesn’t always require a massive income or complicated investment strategies. One of the most effective steps you can take is to establish a consistent savings habit….

National debt is often discussed in the news and by policymakers, but how does it really affect you and your finances? Understanding the implications of a growing national debt can…

Zelle is a popular digital payment platform that allows you to send and receive money instantly between bank accounts in the U.S. Unlike traditional payment apps, Zelle works directly with…

In 2025, the “No Buy” trend is gaining traction as a powerful way to regain control over personal finances. The idea is simple: commit to avoiding unnecessary purchases for a…