2025 is shaping up as a pivotal year in both mobility tech and public markets. Two major stories broke recently: Both moves offer insight into where capital is flowing in…

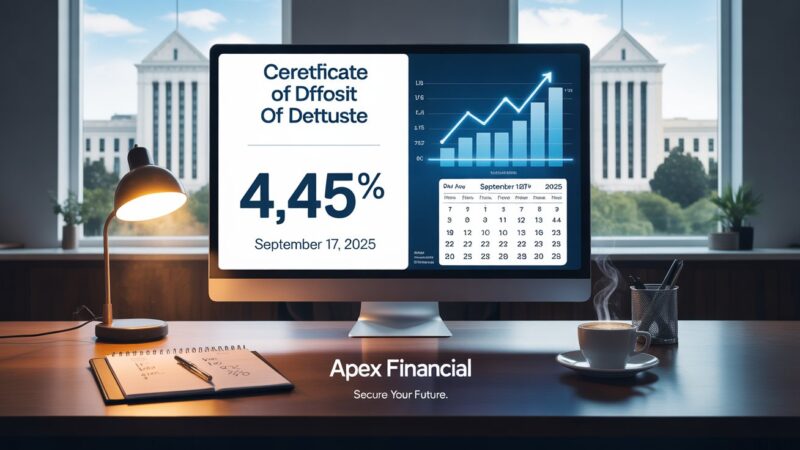

As of September 17, 2025, savers are facing a pivotal moment in the U.S. financial landscape. Certificate of Deposit (CD) rates remain historically high, offering up to 4.45% APY on…

When it comes to planning memorable family vacations without overspending, smart financial tools can make a world of difference. By strategically pairing a travel credit card with a high-yield savings…

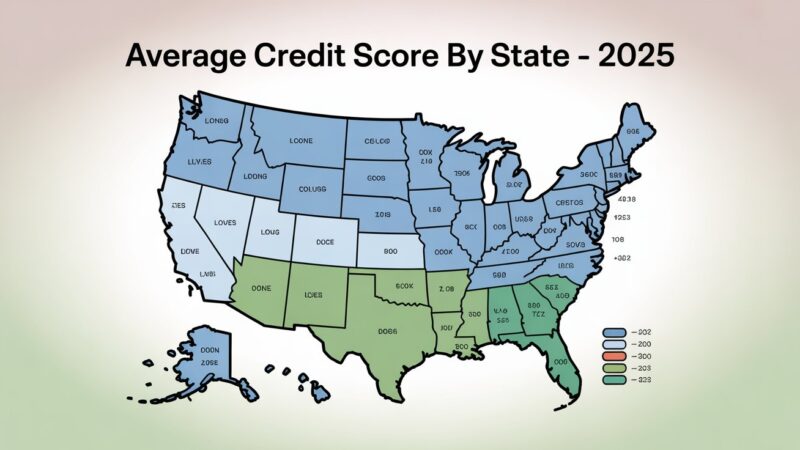

Understanding credit scores is essential for anyone looking to build wealth, qualify for loans, or secure better interest rates. In 2025, the national average credit score in the U.S. remains…

When it comes to personal finance, few numbers carry as much weight as your credit score. This three-digit number can influence your ability to get a mortgage, qualify for a…

When it comes to personal finance, one of the most common questions is: How much money should you really keep in your checking account? With rising living costs, digital banking…

In today’s uncertain economy, many investors are looking for safe and predictable ways to grow their money. One of the most reliable strategies is building a CD ladder. A CD…

Saving $10,000 in a year might seem like a daunting goal, but with the right strategy, discipline, and mindset, it’s completely achievable. Whether you want to build an emergency fund,…

Opening a bank account for someone else can be necessary in various situations, such as helping a minor, elderly relative, or someone who is unable to manage their finances independently….

Your credit report is one of the most important factors that lenders, landlords, and even employers consider when evaluating you financially. However, mistakes on your credit report can happen, and…