Looking to make your money work smarter in 2025? Navigating fixed-income investments through digital platforms has never been easier or more attractive. In this post, we’ll unveil the 5 best digital accounts for fixed-income investing—especially tailored for Brazilian investors—and provide critical insights into what makes each one stand out.

1. Banco Inter Investimentos

- Why it stands out: Integrated with Inter’s digital banking, the platform offers a modern, unified experience combining everyday banking and investments. It lets you invest in fixed-income products with minimal fees and convenient access. Acessei

- Key features:

- Fee-exempt investments

- Seamless app-to-account management

- Broad range of fixed-income products

2. Toro Investimentos

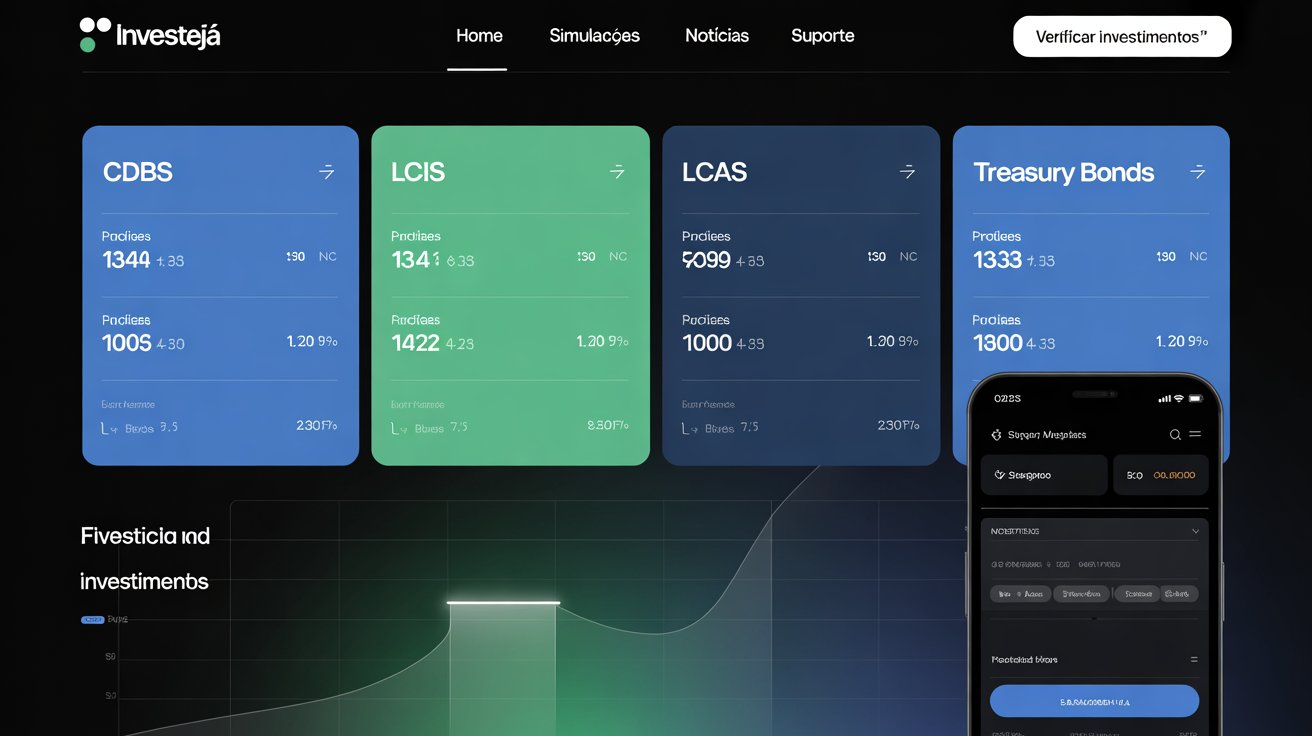

- Why it stands out: A zero-fee investment broker known for its simplicity and cost-efficiency. Offers CDBs, LCIs/LCAs, and bonds with educational tools and advisory support. AcesseiDirrix

- Best for: Cost-conscious beginners and diversified fixed-income investors.

3. Rico / XP Investimentos

- Why it stands out: Backed by XP Inc., Rico provides a modern interface, wide product range, and strong educational content with zero-rate options. XP adds personalized advice and access to more complex fixed-income products like Tesouro Direto. Glooux+1

- Best for: Investors seeking both convenience and expert-level guidance.

4. BTG Pactual Digital

- Why it stands out: The digital arm of Brazil’s leading investment bank offers a robust multilayered platform with auto-rebalancing, sophisticated instruments (CDB, LCI, LCA, LF), and premium-level tools. Wikipedia

- Best for: Advanced or affluent investors seeking institutional-grade digital fixed-income tools.

5. Tesouro Direto via Authorized Platforms

- Why it stands out: The go-to for direct access to Brazilian government bonds. Easily accessible through Blue-chip brokers like XP, Itaú, or Clear. Offers convenience, transparency, and direct ownership. Rusalowww.investortrip.com

- Best for: Safest fixed-income investment directly backed by the government.

Summary Table

| Rank | Platform | Key Advantage | Ideal For |

|---|---|---|---|

| 1 | Banco Inter | Smart banking–investment integration | Everyday users & digital natives |

| 2 | Toro Investimentos | Zero fees + educational tools | Budget-savvy beginners |

| 3 | Rico / XP Investimentos | Full services + guidance | Investors wanting both learning & depth |

| 4 | BTG Pactual Digital | Institutional tools + variety | Serious investors & wealthier profiles |

| 5 | Tesouro Direto Platforms | Direct government bond access | Safety-first, low-risk investors |

best fixed income accounts 2025, digital fixed income investment Brazil, CDB LCI LCA digital platforms, invest fixed income online, Tesouro Direto digital brokers, Toro Investimentos fixed income, Rico XP fixed income, Inter Investimentos CDB, BTG Pactual Digital fixed income, best digital accounts fixed income