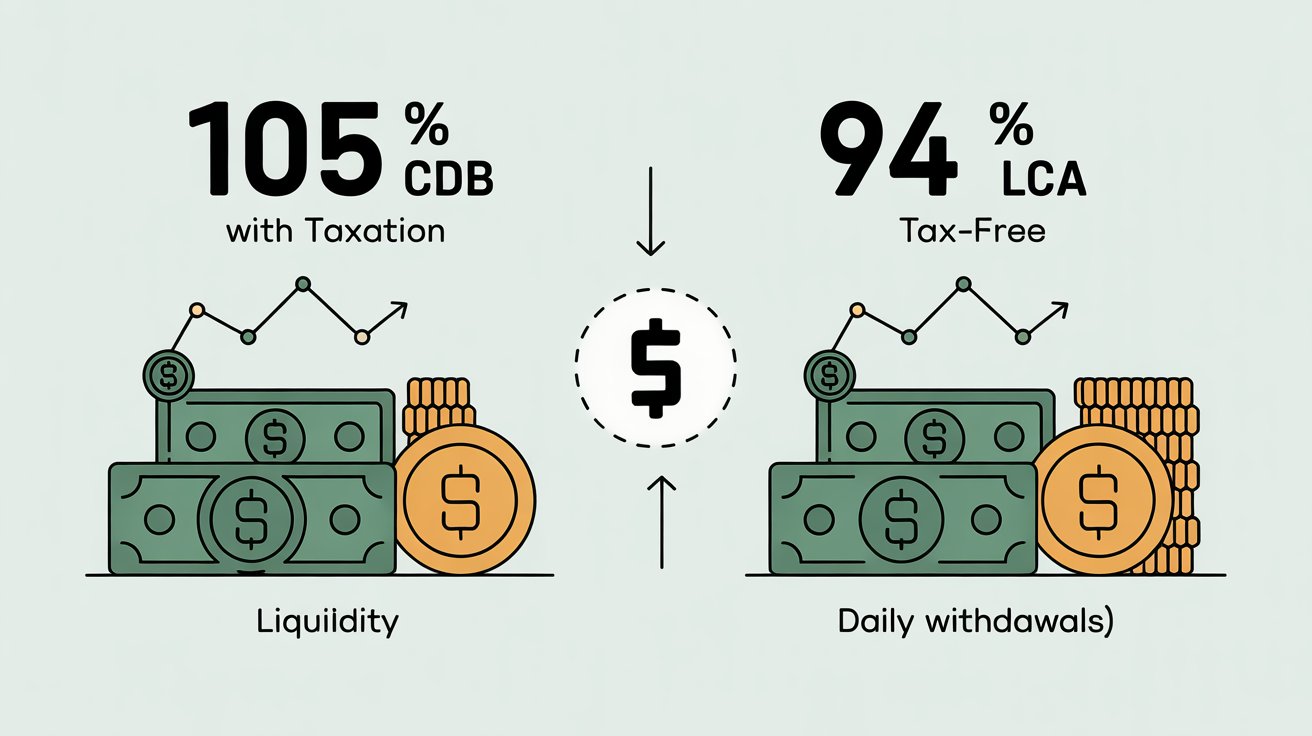

When it comes to fixed income investments in 2025, many investors are asking: Should I choose a 105% CDB or a 94% CDI LCA? Both are safe, low-risk options tied to the CDI (Interbank Deposit Certificate rate), but there are key differences that directly impact your profitability, taxation, and liquidity.

Let’s break it down so you can decide which is the best investment with daily liquidity for your money.

📌 What is a 105% CDB?

A CDB (Certificado de Depósito Bancário) is a fixed-income security issued by banks. When you see 105% of CDI, it means the bank is paying you slightly above the CDI benchmark.

- Liquidity: If the CDB has daily liquidity, you can withdraw anytime.

- Taxation: CDB earnings are subject to Income Tax (IR), which follows the regressive tax table (22.5% to 15%).

- Security: Protected up to R$ 250,000 per CPF per bank by the FGC (Credit Guarantee Fund).

💡 In practice: If CDI is 10% per year, a 105% CDB yields about 10.5% annually — but you must discount income tax.

📌 What is a 94% CDI LCA?

An LCA (Letra de Crédito do Agronegócio) is also a fixed-income investment, but it has a big advantage: it’s tax-free for individuals.

- Liquidity: If it offers daily liquidity, you can redeem your money anytime.

- Taxation: 100% exempt from income tax.

- Security: Also covered by the FGC up to R$ 250,000 per CPF per bank.

💡 In practice: If CDI is 10% per year, a 94% LCA yields 9.4% annually, but since there’s no tax, your net gain can be higher than a CDB in some cases.

📊 CDB vs. LCA: Which Pays More in 2025?

Let’s compare them side by side:

| Investment | Yield (on CDI 10%) | Taxation | Net Return | Liquidity |

|---|---|---|---|---|

| 105% CDB | 10.5% | Yes (15–22.5%) | ~8.1% to 8.9% | Daily |

| 94% LCA | 9.4% | No | 9.4% | Daily |

✅ Conclusion: Even though the CDB offers a higher percentage (105% vs. 94%), the taxation reduces its profitability. The LCA wins in net return if you consider the tax exemption.

⚖️ Final Verdict: The BEST Fixed Income with Daily Liquidity

For most investors in 2025, the 94% CDI LCA is the best choice, thanks to its tax-free advantage and daily liquidity. The 105% CDB can still be attractive if you plan to hold it for longer periods (reducing the tax rate to 15%), but for short-term and emergency funds, the LCA is unbeatable.

If your goal is security, liquidity, and efficiency, the LCA should be your #1 option in 2025.

how to make money online, best fixed income 2025, cdb vs lca, cdb 105 CDI, lca 94 CDI, best daily liquidity investment, how to invest in fixed income, safe investments 2025, CDB or LCA which is better, tax free investment Brazil