When it comes to investing in fixed income in 2025, many investors are asking the same question: Is it better to invest in the Direct Treasury Prefixed 2032 or in…

For years, Tesouro IPCA+ 2029 (Brazilian Treasury Inflation-Linked Bonds) was considered one of the best ways to protect your money against inflation while ensuring attractive real returns. However, the financial…

In Brazil, the Selic rate (Sistema Especial de Liquidação e Custódia) is the benchmark interest rate set by the Central Bank. As of August 2025, the Selic rate stands at…

Investing in Tesouro Direto is one of the most popular ways for Brazilians to grow their wealth safely. Many people wonder: “Can I invest without a bank or brokerage account?”…

When it comes to making money online with secure investments, few options stand out as much as fixed-income securities with daily liquidity. And right now, one of the best opportunities…

When it comes to making money online safely, one of the best strategies in 2025 is investing in CDBs (Bank Deposit Certificates) with daily liquidity. These fixed-income products are backed…

If your goal in 2025 is to generate passive income safely, with predictability and tax advantages, then LCIs (Letras de Crédito Imobiliário) should be on your radar. These fixed-income securities…

In 2025, investors are looking for safe and profitable ways to make money online while keeping their capital liquid. One of the most attractive opportunities in the fixed income market…

With Brazil’s Selic rate at 15% per year, investors are presented with lucrative opportunities in fixed-income investments, particularly in Real Estate Credit Bills (LCIs) and Agribusiness Credit Bills (LCAs). These…

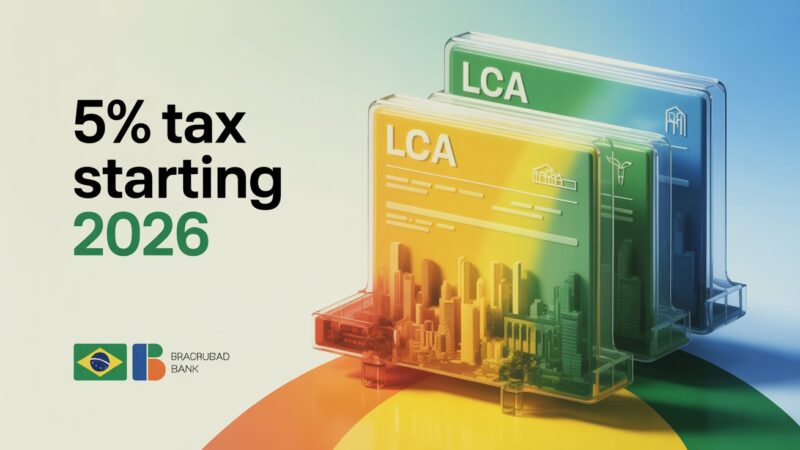

Brazil’s financial landscape is evolving fast. As part of its broader fiscal overhaul under Provisional Measure No. 1,303/2025, the government plans to end the income tax exemption on traditionally incentivized…