The Federal Reserve’s interest rate decisions have a ripple effect across the entire financial system, influencing how you manage your money, borrow, and invest. Understanding these changes is critical to…

U.S. Federal Reserve Outlook What This Means for Borrowers & Homeowners Summary Table Factor Insight Fed’s planned cuts 2 cuts expected—likely in September and December Market sentiment Pricing in multiple…

In 2025, more people than ever are using financial tools and apps to manage money, budget expenses, invest, and track savings. From budgeting platforms like Mint and YNAB to investment…

When it comes to money management, one question often sparks debate: Are men or women better at saving money? Financial habits vary across gender, culture, and income levels, but recent…

When it comes to measuring prosperity in America, one of the clearest indicators is household income. As of 2025, U.S. Census Bureau data and economic research show that certain states…

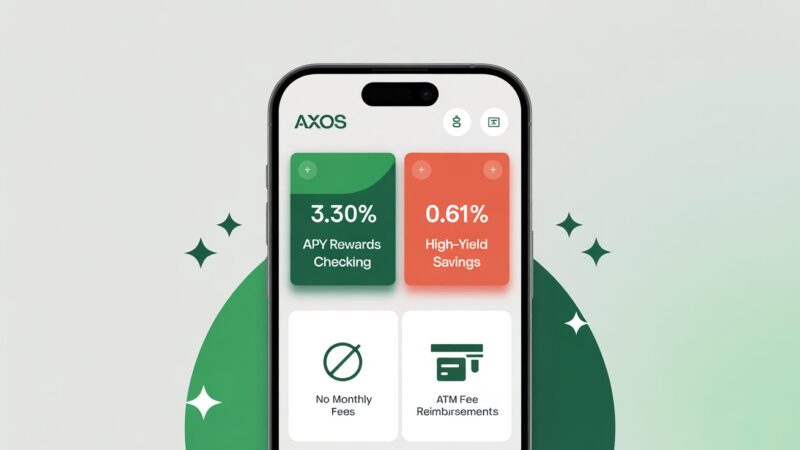

Axos Bank continues to stand out in the digital banking space in 2025, offering standout rewards checking and high-yield savings accounts with no monthly maintenance fees. Ideal for savers and…

If you’re looking to grow your savings safely, Certificates of Deposit (CDs) remain one of the most reliable options. In September 2025, several banks are offering promotional CD rates as…

A sudden drop in your credit score can feel like a financial nightmare, especially when you’re unsure why it happened. Your credit score is more than just a number—it affects…

Saving money in 2025 has become both easier and harder. Easier because of new financial tools, apps, and investment platforms. Harder because inflation, rising living costs, and lifestyle temptations are…

A new survey reveals that 1 in 3 Americans say their financial situation has worsened in the past year. Rising inflation, increasing debt, and stagnant wages are leaving many households…