The fintech industry has exploded over the past decade, and Upgrade Bank continues to stand out as one of the top players in 2025. Known for its innovative technology, customer-friendly…

When most people think about infidelity, they immediately picture romantic or physical betrayal. But there’s another type of dishonesty that can destroy relationships just as quickly: financial infidelity. Money is…

In 2025, digital banking continues to redefine how we manage money, and Chime remains at the forefront of this revolution. By leveraging cutting-edge technology, Chime offers users smarter, faster, and…

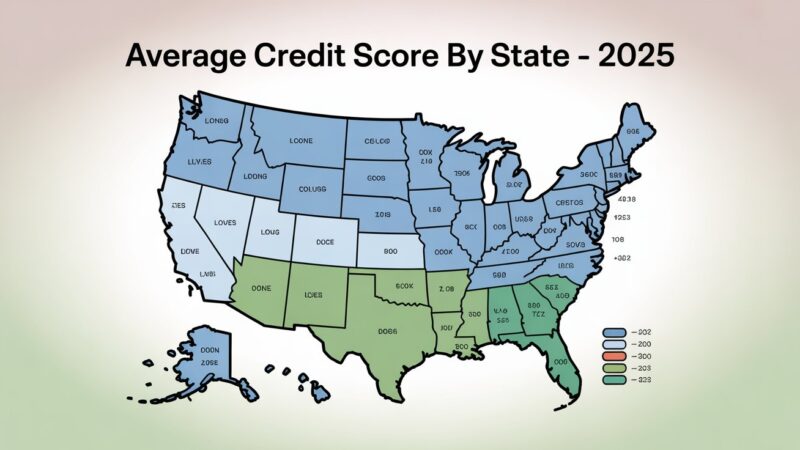

Understanding credit scores is essential for anyone looking to build wealth, qualify for loans, or secure better interest rates. In 2025, the national average credit score in the U.S. remains…

When it comes to online banking in 2025, consumers want two things: high interest rates and low fees. Vio Bank continues to stand out as a competitive option in the…

In the current low-fee, high-yield banking environment, CIT Bank (part of First Citizens Bank) is standing out. In 2025, it offers several no-fee, interest-earning checking and savings options, along with…

When it comes to online banks in 2025, Quontic Bank has positioned itself as one of the most innovative players in the U.S. market. Known for its competitive savings rates,…

Understanding your monthly cash flow is one of the most important steps to achieving financial stability and building long-term wealth. Whether you’re a student, a young professional, or a family…

If you’re looking for a high-yield online savings account in 2025, Poppy Bank is quickly becoming a top choice for savers across the United States. Based in California, Poppy Bank…

When it comes to personal finance, few numbers carry as much weight as your credit score. This three-digit number can influence your ability to get a mortgage, qualify for a…