In 2025, the United States financial markets are entering a new phase of uncertainty. For the past two years, inflation has been the dominant factor shaping Federal Reserve (Fed) policy. However, investors and analysts now believe the focus may be shifting toward the employment market.

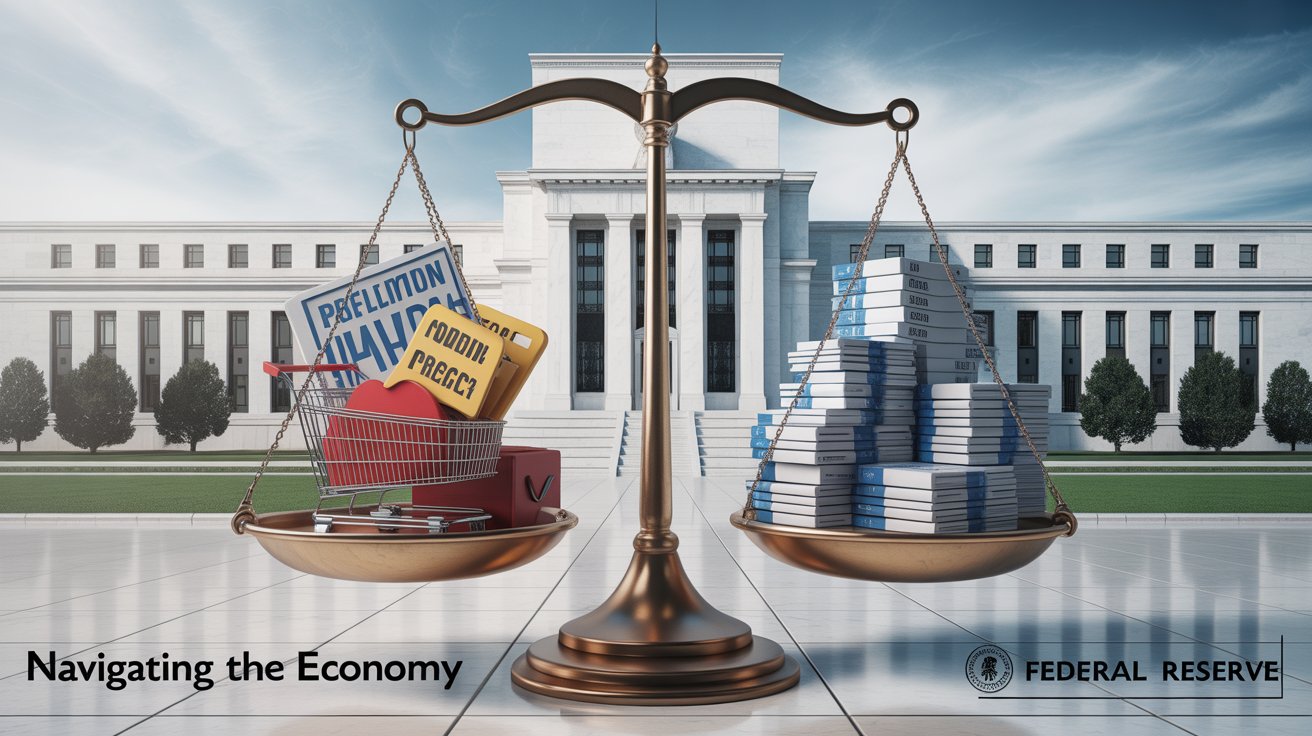

Inflation vs. Employment: A New Balance of Risks

The Federal Reserve has long relied on the Personal Consumption Expenditures (PCE) index as its preferred measure of inflation. While inflation remains a concern, the August PCE data is projected to show only a slight increase, suggesting that inflationary pressures are stabilizing.

With inflation no longer at record highs, the central bank’s attention is gradually pivoting toward the health of the labor market. This shift is critical because unemployment levels and job creation are directly tied to consumer spending, economic growth, and long-term market stability.

Why Employment Matters More in 2025

The US economy has been resilient, but cracks are starting to appear:

- Slower hiring in key sectors like technology and retail.

- Rising layoffs in certain industries, especially manufacturing.

- Wage growth cooling, which could ease inflation but signal weaker demand.

The Fed faces a delicate balance: cutting rates too early could reignite inflation, while keeping them high for too long risks slowing job creation and increasing unemployment.

Market Implications of a Labor-Focused Fed

For investors, the Fed’s shift in focus could have major implications:

- Stock Market Volatility – If job reports come in weaker than expected, markets may price in faster rate cuts, fueling short-term rallies.

- Bond Yields – Treasuries could decline as investors anticipate lower rates in the near future.

- Currency Markets – A weaker labor market outlook may put downward pressure on the US dollar.

- Investor Sentiment – The narrative is moving away from “inflation fear” toward “recession risk,” which changes portfolio strategies.

Investor Strategy in a Shifting Environment

In this new environment, investors should consider:

- Diversification into defensive sectors like healthcare and utilities.

- Fixed income opportunities as yields remain attractive but may fall in 2025.

- Growth stocks that benefit if the Fed eases monetary policy earlier than expected.

Final Thoughts

The Federal Reserve’s policy pivot from inflation to employment marks a turning point for financial markets. For investors, understanding this transition is crucial to making smart decisions in the months ahead. The health of the US job market will not only influence the Fed’s next moves but could also determine the trajectory of the global economy in 2025.

US stock market, Federal Reserve 2025, US employment data, PCE inflation index, labor market outlook, Fed interest rates, US economy news, investing in 2025, stock market forecast, bond yields 2025, US dollar outlook