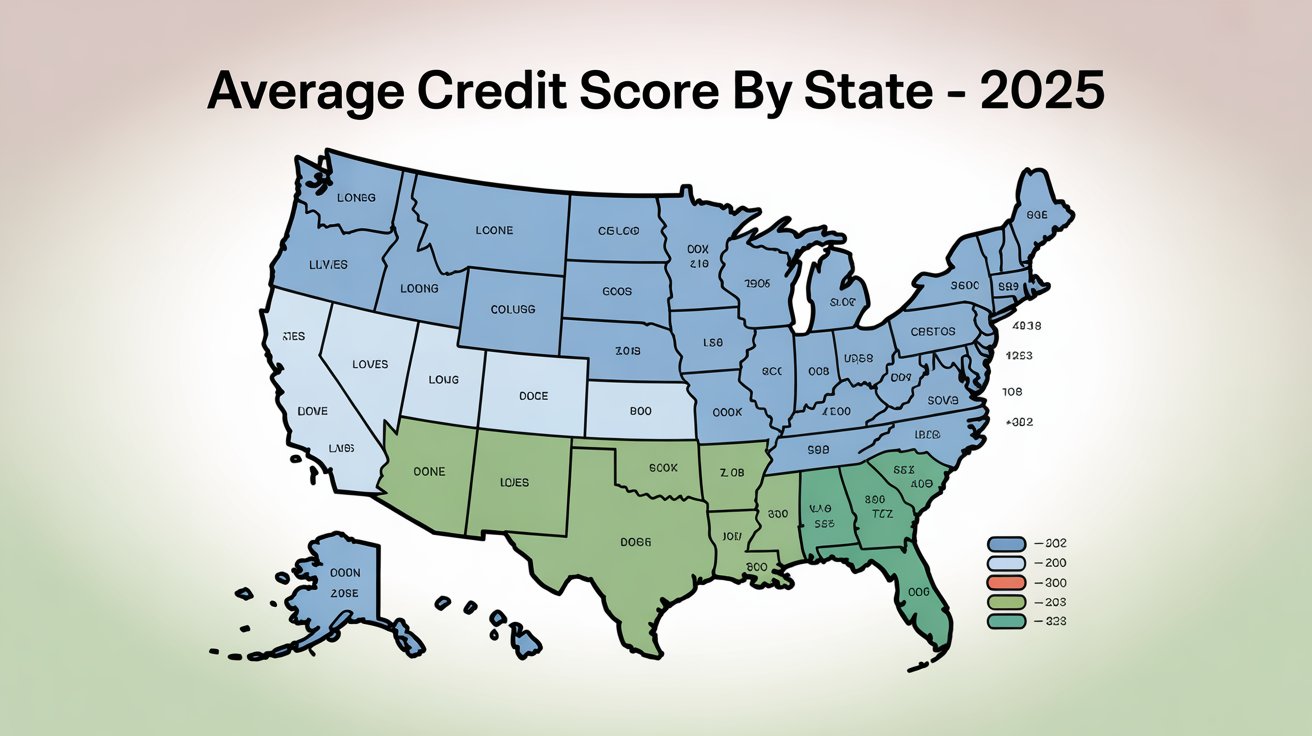

Understanding credit scores is essential for anyone looking to build wealth, qualify for loans, or secure better interest rates. In 2025, the national average credit score in the U.S. remains strong, but there are significant differences from state to state. This map highlights the average credit score by state in 2025, giving you insight into where Americans are excelling at managing credit—and where challenges still exist.

Why Credit Scores Matter in 2025

A credit score affects almost every financial decision:

- Loan approvals – Mortgage, auto, and personal loans often require higher scores.

- Interest rates – A higher score usually means lower borrowing costs.

- Insurance premiums – In many states, credit impacts insurance pricing.

- Employment opportunities – Some employers review credit history for financial positions.

As inflation, higher borrowing costs, and increased credit card usage impact households, maintaining a healthy credit score has become even more important in 2025.

States with the Highest Average Credit Scores

The top states consistently show strong financial discipline, lower debt-to-income ratios, and fewer late payments. In 2025, states such as Minnesota, Vermont, and New Hampshire continue to lead the nation with average credit scores above 730, reflecting excellent credit health.

States with the Lowest Average Credit Scores

On the other hand, southern states such as Mississippi, Louisiana, and Alabama tend to have lower average credit scores, generally falling between 660–670. Economic challenges, higher reliance on credit, and lower household incomes contribute to these differences.

National Credit Score Trends in 2025

- Stability: The national average hovers around 718, close to 2024 levels.

- Rising debt: Credit card balances are at all-time highs, putting pressure on household finances.

- Generational differences: Gen Z shows faster score improvement compared to Millennials and Gen X, largely due to earlier adoption of credit-building tools.

- Digital banking: Fintech platforms and AI-driven financial apps are helping people monitor and improve their credit in real-time.

How to Improve Your Credit Score in 2025

No matter which state you live in, these strategies can help you boost your score:

- Pay bills on time – Payment history is the biggest scoring factor.

- Lower credit utilization – Keep balances under 30% of your credit limits.

- Avoid unnecessary hard inquiries – Too many applications hurt your score.

- Build a mix of credit – Installment loans and revolving accounts strengthen profiles.

- Use credit monitoring tools – Apps like Credit Karma, Experian Boost, or bank dashboards can track progress.

Final Thoughts

The average credit score by state in 2025 highlights both opportunities and challenges across the country. Whether your state is leading or lagging, the good news is that individuals can always take control of their credit future. With smart money management and the right tools, improving your credit score is possible no matter where you live.

average credit score 2025, average credit score by state 2025, US credit score map 2025, state credit score rankings 2025, credit score statistics 2025, improve credit score 2025, national credit score average 2025, best credit score states 2025, worst credit score states 2025