Axos Bank continues to stand out in the digital banking space in 2025, offering standout rewards checking and high-yield savings accounts with no monthly maintenance fees. Ideal for savers and spenders alike, Axos blends convenience with competitive APYs—when you meet certain requirements.

Rewards Checking Account

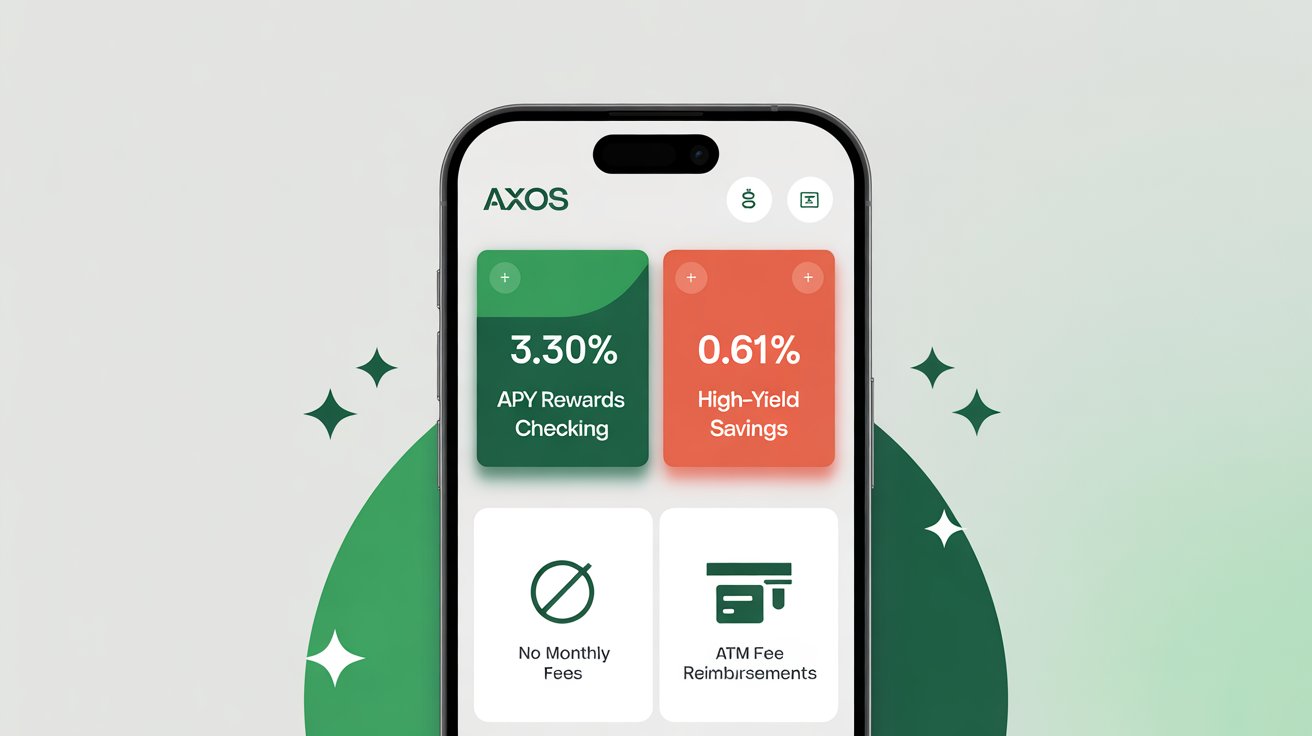

Axos Bank’s Rewards Checking can deliver up to 3.30% APY on balances up to $50,000 — a rate far above national averages Forbes+1Kiplinger.

How to Maximize Earnings

To earn the full APY, you must meet several requirements each month:

- 0.40% APY: At least $1,500 in monthly direct deposits KiplingerForbes.

- 0.30% APY: Complete 10 debit card transactions or use Axos’s Personal Finance Manager (PFM) tool KiplingerForbes.

- 0.99% + 0.99% APY: Maintain $2,500 average daily balance in both an Axos Invest Managed Portfolio and Self-Directed Trading account KiplingerForbes.

- 0.60% APY: Make your monthly Axos consumer loan payment via Rewards Checking KiplingerForbes.

Account Highlights

- Zero fees: No monthly maintenance, overdraft, or NSF fees; $0 to open Forbesaxosbank.com.

- ATM fee reimbursement: Unlimited domestic ATM fee reimbursements Forbes+1.

High-Yield Savings Account

Axos’s High Yield Savings Account features a decent APY of 0.61% for balances under $25,000, with tiered reductions for higher balances (down to 0.25% and 0.15%) ForbesTIMEweb.axosbank.comBankrate.

Account Perks

- No monthly fees and no minimum balance requirement beyond the modest opening deposit (~$250) ForbesTIMEBusiness Insider.

- Free ATM card available on demand—a rare feature among savings accounts Forbesweb.axosbank.com.

However, be aware: The APY is lower than what many other online banks are offering, making this less competitive for purely savings-focused users TIMEBankrateFinanceBuzz.

Axos ONE Bundle: Checking + Savings

The Axos ONE bundle, combining checking and savings, offers exceptional rates—up to 4.66% APY on savings and up to 0.51% on checking when meeting conditions such as $1,500+ monthly direct deposits and maintaining a $1,500 balance Kiplinger.

Even without meeting those thresholds, the Summit Savings alternative gives about 4% APY with no minimums Kiplinger.

Pros & Cons

| Pros | Cons |

|---|---|

| Up to 3.3% APY on checking with no fees and ATM reimbursements | APY requires multiple hoops to jump through |

| Solid 0.61% savings APY, no fees, no balance requirement, ATM card included | Savings APY lower than top-tier online competitors |

| Axos ONE bundle delivers top-tier yields when bundled | No physical branches; online-only access |

| All accounts include ATM fee reimbursements | Some users report frustrations with app stability and customer service Reddit+1 |

Final Verdict

Axos Bank in 2025 is a strong option for those who can actively manage their finances and meet the requirements for high APYs. The Rewards Checking account delivers top-tier returns for digital-savvy users. The High Yield Savings, while fee-free and convenient, is best for those who prefer simplicity over maximum interest. The Axos ONE bundle provides impressive yields for both checking and savings, making it an excellent choice for integrated banking.

Bottom line: If you’re comfortable with digital-only banking and are happy to meet account conditions, Axos Bank can be highly rewarding. For purely passive savers, you may find higher rates elsewhere.

Axos Bank 2025, Axos Bank review, rewards checking, high yield savings, no monthly fees, best online bank 2025, Axos ONE, Axos rewards checking APY, Axos savings APY, digital banking