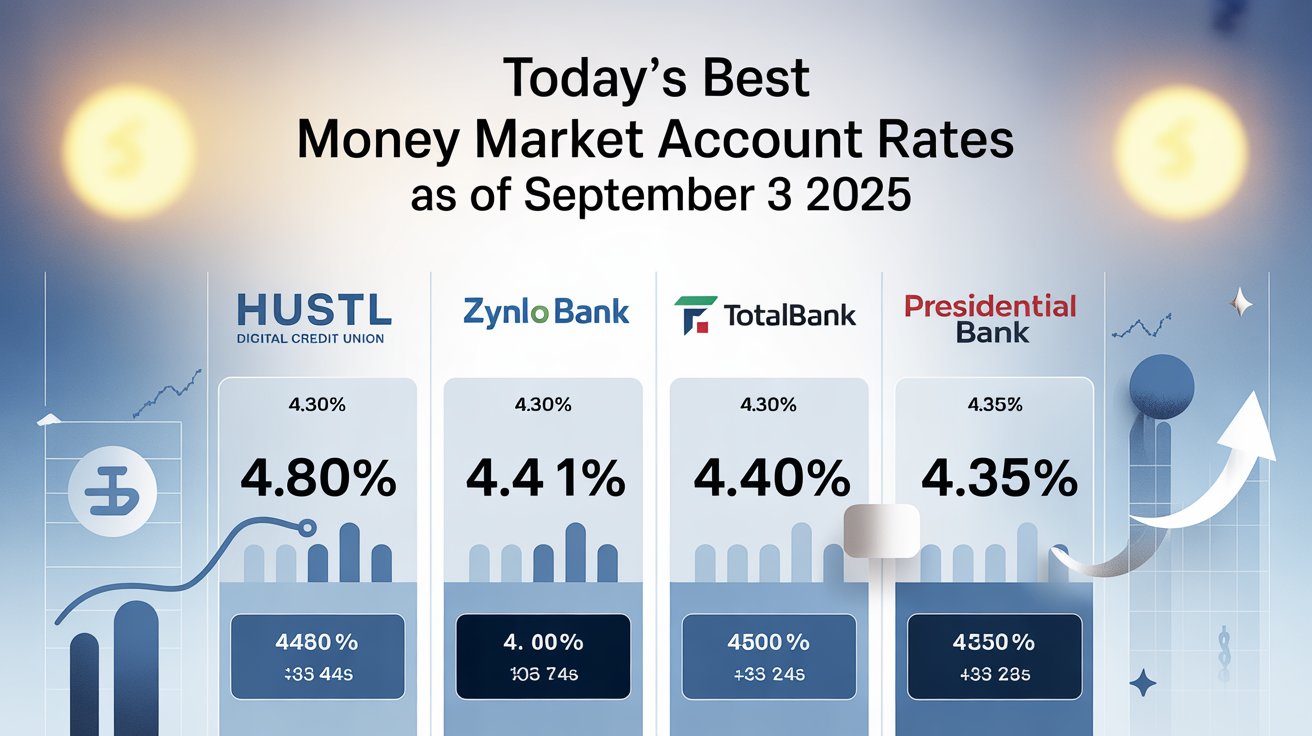

As of today, September 3, 2025, savvy savers can earn incredibly competitive rates on money market accounts—some as high as 4.41% APY, offering a rare opportunity to grow your savings while preserving easy access and security.

Best Money Market Rates Right Now

According to Yahoo Finance’s current report, top money market account rates can reach 4.41% APY as of September 3, 2025 Yahoo Finanças.

Investopedia’s most recent update (September 2, 2025) lists even higher rates, including 4.80% APY at HUSTL Digital Credit Union, followed by 4.37% at Presidential Bank and 4.35% at Brilliant Bank, among others Investopedia.

Standout Accounts at a Glance

| Institution | APY | Key Notes |

|---|---|---|

| HUSTL Digital Credit Union | 4.80% | No minimum balance; membership via a small donation and savings account requirement Investopedia |

| Presidential Bank | 4.37% | Requires $25,000 balance to earn APY; checking features included Investopedia |

| Brilliant Bank | 4.35% | Top-tier rate with moderate requirements InvestopediaKiplinger |

| TotalBank (City National FL) | 4.41% | Requires $25,000 to open, $2,500 to earn; operates like savings, no check-writing Investopedia |

| Zynlo Bank | 4.40% | Low deposit requirement; check-writing via associated checking only InvestopediaBankrate |

| Badass Bank, OnPath CU | ~4.40% | Various membership or balance requirements Investopedia |

| CFG Bank | 4.32% | $1,000 minimum to open and earn; may charge fees if requirements unmet BankrateInvestopedia |

| Vio Bank | 4.31% | $100 minimum; often highlighted in top picks BankrateNerdWallet |

How to Choose the Right MMA for You

- Compare APYs vs. Access Needs

A rate like 4.80% (HUSTL) is exceptional, but requires meeting membership and savings criteria. Evaluate whether easier access (checks, debit cards) or a slightly lower rate might suit your needs better. - Minimum Opening & Balance Requirements

- Zynlo: Very low entry (~$10) Investopedia

- TotalBank: $25,000 to open, but lower balance ($2,500) to earn full APY Investopedia

- Presidential Bank: $25,000 ongoing balance required Investopedia+1

- Access & Convenience

- Some accounts, like TotalBank, function like savings with no check-writing privileges.

- Others, like Presidential Bank and Zynlo (via associated checking account), offer limited checking access Investopedia.

- Fees & Restrictions

- CFG Bank may levy $10/month if you don’t maintain a $1,000 balance BankrateInvestopedia.

- OnPath CU allows only three fee-free withdrawals monthly Investopedia.

- Federal Rate Changes Ahead

With the Fed signals pointing possible rate cuts later this year, locking in today’s high MMAs could secure excellent returns before rates dip Kiplinger+1.

Actionable Tips

- Prioritize accounts offering both high APY and flexible access (e.g., check-writing, debit cards).

- Ensure you meet minimum balance requirements to avoid forfeiting high yields or incurring fees.

- Diversify: consider splitting funds between MMAs and short-term CDs to hedge against potential rate declines Kiplinger.

- Stay tuned to Federal Reserve updates—MMAs are highly sensitive to the Federal Funds Rate trajectory InvestopediaKiplinger.

money market account rates, best money market accounts, 4.41% APY, September 3 2025, high yield savings, MMA rates today, HUSTL credit union rate, Zynlo Bank MMA, Presidential Bank APY, TotalBank money market